According to a recent report from IDC, social enterprise software will grow from $800 million in 2011 to $4.5 billion by 2016. Despite Facebook’s greedy IPO last May, and disappointing Q2 results from both Facebook and Zynga, social enterprise software is doing fine. Six of the sixteen M&A transactions in the sector during the past 2.5 years occurred since Facebook’s IPO. These six transactions totaled over $2.5 billion, with $1.2 billion coming from Microsoft’s Yammer acquisition last month. What is even more interesting is that enterprise software mega-vendors (Oracle, Microsoft, and Salesforce) plus Google drove these acquisitions.

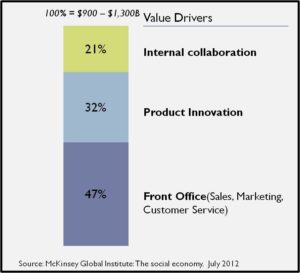

Social enterprise software is only now entering its rambunctious adolescent years. The McKinsey Global Institute just published a report placing the ‘annual value that could be unlocked by social technologies’ at up to $1.3 trillion. See the chart on the right for the distribution of those benefits. While one can argue whether this figure is realistic, few will argue on the overall potential.

In addition, McKinsey highlighted that ‘realizing such gains will require significant transformations in management practices and organizational behavior’. As I mentioned in an earlier post, people are the weakest link.

The emerging Social Enterprise Software stack

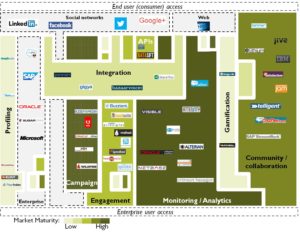

The chart on the left represents my depiction of the social enterprise software stack – it looks messy because it is. The colors represent how mature (i.e., commoditized) each sub-sector is. In general, I expect to see more innovation from the less mature sectors over the next few years. At the same time, the more mature sub-sectors will consolidate much faster.

The chart on the left represents my depiction of the social enterprise software stack – it looks messy because it is. The colors represent how mature (i.e., commoditized) each sub-sector is. In general, I expect to see more innovation from the less mature sectors over the next few years. At the same time, the more mature sub-sectors will consolidate much faster.

So here are my observations:

- Enterprise software vendors signaling the importance of the market: While their approaches may vary, by now all enterprise software mega-vendors (Adobe, IBM, Microsoft, Oracle, Salesforce, and SAP) have either built and/or acquired social capabilities. This is a strong indication that, despite the hype, the social media transformation will only accelerate in the coming years.

- The platform wars are only beginning: In addition to the acquisition spree, pure-plays are also expanding across sub-sectors with the intent of becoming true platform/suite players (e.g., Engagement vendors entering the Monitoring / Analytics and Integration sub-sectors, Campaign vendors entering Engagement, Community / Collaboration vendors building Gamification capabilities, etc.). My depiction maps companies to a specific sub-sector based on their core competitive differentiation. Most companies today will claim they play across multiple sub-sectors, but few do well.

- User experience becomes a key competitive advantage: As I have argued before, the user experience will separate the winners from the losers. The consumer web has fundamentally changed enterprise users’ expectations. As a result, companies stuck in the old paradigm will be left behind.

- Emerging sub-sectors driving innovation: When Jeremiah Owyang from the Altimeter Group published his perspective on the stack in 2010, there were no Profiling or Gamification companies present. Today, companies in these sub-sectors are driving much of the innovation.

In closing, I want to ensure my views on market maturity are taken in context. According to IDC, this sector will grow by 42% each year over the next 4 years. I do not believe there is any other enterprise software sector coming even close to this figure.

What do you think? Do you believe IDC’s predictions? Do my observations reflect the state of social enterprise software today? I will provide more details for each sub-sector in the next installment. In the meantime, your input and feedback are, as always, welcome.

Update (August 15): You can continue to Part 2 here.

The dynamics of collaboration within the enterprise for internal collaboration and product innovation (sometimes referred to as B2E and E2E) are very different from external collaboration (B2C or C2C). Deriving measurable benefits from Enterprise Collaboration requires a strong Change Management component as well as a well conceived integration plan with the existing (and ever changing) application ecosystem.

Eric thanks, you are absolutely correct. I believe the change management aspect will even surpass that of the Business Process Re-engineering movement in the 1980s. Interestingly enough AntsEyeView, one of more well-known strategic social consulting companies, was just acquired yesterday by PwC . I expect a lot more to come in the coming years.

Ted, I think your observations reflect the state of the enterprise software play today. The future direction and growth of the platforms, I believe in good part, is going to be governed by three factors.

The first, you have touched upon: consumer experience. Enterprise software users, in particular new entrants into the workforce, acculturated with social media are increasingly going to expect and demand consumer type UX / UI.

The second is an open global collaboration space whereby individuals and businesses can come together and engage each other in B2B, B2C and P2P collaboration. The benefits of open collaboration, in more and more cases, are likely to trump the risks. The exponential growth of social media is but a testament.

Lastly, it is the integration of consumer and business Collective Intelligence, which currently exists in isolated and fragmented silos even in enterprises. The emerging enterprise platforms will need to provide the means for creating, capturing, and building the combined Collective Intelligence both across the enterprise and on a global scale, and be able to tie everything together seamlessly: connect people, processes and expertise.

Currently, to my knowledge, the only enterprise software that provides all three is Xincus (www.xincus.com) which was launched in May. Perhaps in time it will find its way on your Social Enterprise Software stack.

Michael, thank you for your thoughtful comments. Indeed, collaboration both within a company’s four walls but also across their extended ecosystem will be a key growth driver in this space. There are a number of such platforms today, from the open social networks, to the social enterprise software collaboration platforms, to niche ideation platforms such as Innocentive. Thank you for bringing Xincus to my attention, there are many innovative companies today, and my list was certainly not meant to be exhaustive.