Imagine this scenario: SaaS enterprise software vendor gives away their enterprise solution for free in exchange for access to the underlying (anonymized) data and /or their users’ eyeballs. While this may sound like a far-fetched scenario, I do not think it is. Let’s look at a couple of examples…

Content: According to Outsell, a leading market research firm dedicated to this industry, the data industry is worth more than $400B. While this figure includes categories such as news, search, education, and directories, the addressable market for data consumed within the context of enterprise applications is more than $45B. Companies such as Nielsen, IRI, Thomson Reuters, and Dun & Bradstreet have built multi-billion dollar businesses on the premise of getting access to enterprise data (such as point-of-sales and financial performance data), aggregating it, and selling it back to enterprises. In addition, a number of smaller companies such as ZoomInfo and Jigsaw (which was acquired by Salesforce in 2010 and is now integrated into data.com), leverage publicly available contact information to help sales and marketing professionals target their campaigns. And of course, let’s not forget LinkedIn with its recent forays to monetize its 150M+ user base beyond its core recruiting market. No enterprise software company however has been able to tap into its rich customer data at scale.

Advertising based monetization: This is an area that is largely untapped within the enterprise. The one glaring exception is Spiceworks, a company most of us have never heard of. Spiceworks was founded in 2006 on this very premise and has already raised $54M in venture funding. They provide a free network management solution for IT administrators and have since built a 2M member community that they monetize exclusively through targeted advertising.

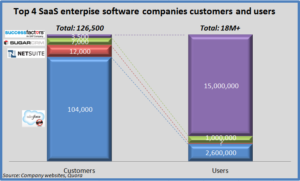

In my opinion, the largest opportunity lies in the enterprise SaaS market, both because of the implied consistency of the underlying data models across customers, but also because of the increased flexibility to serve this advertising. The four largest enterprise SaaS companies claim more than 125K customers and more than 18M users. Now imagine the value of being able to benchmark your sales, supply chain, financial, HR, etc. performance with that of your peers all from within your enterprise solution. Now also imagine that while you are reviewing the performance of your widget suppliers, you receive a targeted advertisement from a supplier you are not currently doing business with.

In my opinion, the largest opportunity lies in the enterprise SaaS market, both because of the implied consistency of the underlying data models across customers, but also because of the increased flexibility to serve this advertising. The four largest enterprise SaaS companies claim more than 125K customers and more than 18M users. Now imagine the value of being able to benchmark your sales, supply chain, financial, HR, etc. performance with that of your peers all from within your enterprise solution. Now also imagine that while you are reviewing the performance of your widget suppliers, you receive a targeted advertisement from a supplier you are not currently doing business with.

Now I do realize, there are many potential concerns for both

- SaaS enterprise software vendors: How can I fund my significant upfront R&D expenses if I can’t monetize immediately, and their,

- Customers: How could I ever possibly entrust a vendor with my sensitive data, how could I allow my enterprise software vendor to distract my employees with advertising while on the job?

But, are they really that insurmountable?

What do you think? Is this a far-fetched scenario, or is the SaaS enterprise software industry ready for disruption?

Ted – interesting post. We are thinking of a similar model within our Social Analytics SaaS solution (http://nextprinciples.com).

However, for us, the issue is not about funding and monetization but more about whether the advertising model is a nuisance that our users would prefer to not be bothered with.

I think there are other models of monetization possible without advertising (or should I say ‘guesswork’) popping in. We will be validating these models with our users and customers in the upcoming months.

Satya, thank you for your comment. While I am not advocating that ad-based monetization will work for all enterprise software solutions, I believe you might be surprised that buyers might not be opposed to this, assuming you can provide value through those ads. While the procurement area is an obvious one, for your market targeted ads for marketing agencies might be appropriate. In any case, validating these hypotheses with your users and customers is the right step.

From a vendor, SaaS perspective, it seems like the key would be to provide single player value to enterprise employees (but ideally with some network effect as well for growth). Managers may think twice about introducing an ad based, free / freemium vendor to their company, but employees may prioritize getting the work done. If a free / freemium vendor can help them do that, I don’t think it’s impossible that an ad based service could get some traction in the enterprise.

Lawrence thanks, in my post I am actually referencing ads targeted to the user’s role within the enterprise and not their personal interests. It will of course come down to weighing the potential value of such ads to the enterprise vs the perceived or true distraction.

Hi Ted,

Good post. One question – advertising model works when the product is free for the user, while the # and type of users is the actual ‘product’ sold to the advertisers. Can this ever be true in an enterprise, where companies pay for software?

In a user-productivity app (like EverNote) in the enterprise, it could work, but harder to imagine that for a regular app (e.g., CRM). Or do you see that as subsidizing the app price? It’s probably a much bigger leap than consumer world.

Alex

Alex, thanks. Yes indeed, my premise is that you could potentially subsidize the price to the customer (i.e., enterprise) by serving ads to the end users in the context of their work. As I mentioned in the post, this is a largely untapped opportunity today with Spiceworks being the only example I know of. There are clearly nuances (e.g., in my opinion Procurement in an SMB context is the most obvious use case), and while this size of the audience will never match the scale in the consumer world, it might be compensated by the value (i.e., cost-per-click) of each ad served. I agree it’s a much bigger leap of faith, hence the title of this post:-) It likely deserves a follow-on post to drill down to the next level.