So, Facebook finally had its long-awaited, largest tech IPO ever today and raised $16B in the process. For the past few weeks, many pundits have been arguing on both sides of the fence whether or not this is a fair valuation. I, on the other hand, have been poring over Facebook’s S-1 for today’s IPO and Google’s S-1 and annual reports from the past few years. Why, may you ask? It’s simple: Because in my view Google is the closest competitor Facebook has today, and I wanted to analyze their relative performance. For starters, I do realize that many of you will consider this comparison anathema, as Facebook is a web 2.0 social network, while Google is such an old web 1.0 search engine. However, the reality is that while the value proposition for their users is different, their business models are still fundamentally the same:

So, Facebook finally had its long-awaited, largest tech IPO ever today and raised $16B in the process. For the past few weeks, many pundits have been arguing on both sides of the fence whether or not this is a fair valuation. I, on the other hand, have been poring over Facebook’s S-1 for today’s IPO and Google’s S-1 and annual reports from the past few years. Why, may you ask? It’s simple: Because in my view Google is the closest competitor Facebook has today, and I wanted to analyze their relative performance. For starters, I do realize that many of you will consider this comparison anathema, as Facebook is a web 2.0 social network, while Google is such an old web 1.0 search engine. However, the reality is that while the value proposition for their users is different, their business models are still fundamentally the same:

Get as many ‘eyeballs’ as you can on your platform, and monetize them (mostly) through advertising.

In order to make an apples-to-apples comparison, I focused most of the analyses on similar periods in their lifecycle, namely years 4-8 (2002-06 for Google and 2007-11 for Facebook).

Based on today’s IPO, Facebook’s valuation is 2.1x that of Google when it was 8 years old

(12-month trailing P/E ratio of 88 vs 41).

But I am getting ahead of myself, let’s look at the similarities first…

- Both Google and Facebook were founded by 20-somethings, the first one at Stanford and the latter at the Stanford of the East (a.k.a. Harvard).

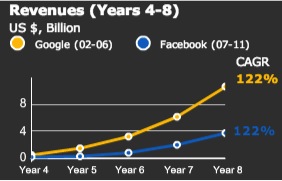

- Revenue growth rate: Both grew at an astounding 122% compound annual growth rate over years 4-8.

- International diversification: By the end of year 8, they both relied outside the US on more than 40% of their revenues.

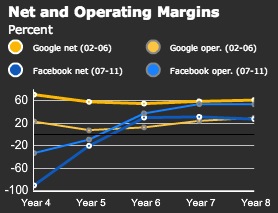

Margins: Their net and non-GAAP operating margins almost converged by year 8. Although Facebook started from a very different place in their year 4 (2007), they were able to increase their efficiency significantly in the following 2 years. Sometimes I wonder what influence Sheryl Sandberg had on this eerily similar performance. She has been Facebook’s COO since 2008 and had spent the previous 6.5 years at Google, laying out many of the same underlying processes during Google’s early explosive growth years.

Margins: Their net and non-GAAP operating margins almost converged by year 8. Although Facebook started from a very different place in their year 4 (2007), they were able to increase their efficiency significantly in the following 2 years. Sometimes I wonder what influence Sheryl Sandberg had on this eerily similar performance. She has been Facebook’s COO since 2008 and had spent the previous 6.5 years at Google, laying out many of the same underlying processes during Google’s early explosive growth years.

Now, what about the differences?

Absolute revenues: Despite the fact that they both grew at the same compound growth rate during years 4-8, Google was almost 3x the size of Facebook by the end of year 8 ($10.6B vs. $3.7B). This is because Google grew much faster than Facebook in their earlier years (e.g., Google hit $1B in revenues in 5 years, while it took Facebook 6.5 years). (+1: Google)

Absolute revenues: Despite the fact that they both grew at the same compound growth rate during years 4-8, Google was almost 3x the size of Facebook by the end of year 8 ($10.6B vs. $3.7B). This is because Google grew much faster than Facebook in their earlier years (e.g., Google hit $1B in revenues in 5 years, while it took Facebook 6.5 years). (+1: Google)

- Advertising revenue dependency: Google was (and still is) significantly more reliant on advertising, as it depended on it for 99% of its revenues, while ‘only’ 85% of Facebook revenues were derived from advertising (12% of the remaining 15% comes through Zynga). While at a first glance, Facebook appears to have been able to diversify its revenue stream earlier, Google did not have a single customer/partner accounting for 12% of its revenues. (+1: Unclear)

- Advertising revenue efficiency: The advertising industry uses ‘intent targeting’ to denote instances when people are expressing their specific intent (e.g., when running a Google search). This is typically not the case for Facebook, as people are not necessarily looking for a product when on the platform. As a result, their demographically-targeted ads are focused higher in the conversion funnel (i.e., brand awareness), an area still dominated by offline media. The implication is therefore that Google’s ‘eyeballs’ are a lot more valuable as a result. This and that study I recently saw show that Google’s click-through rates are ~10x that of Facebook. Forrester Research also recently published a post on some of the challenges Facebook is facing. General Motors just this week also decided to stop advertising on Facebook, since ‘paid ads on the site have little impact on consumers’ car purchases. I have not seen any more extensive studies, but if you have, I would love to see them. (+1: Google)

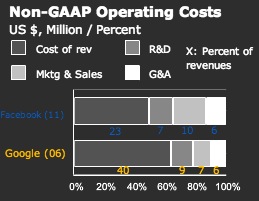

Operating cost structure: First of all, Google’s cost of revenues is significantly higher than that of Facebook, accounting for 40% of its revenues (as opposed to Facebook’s 23%). The primary difference is Google’s traffic acquisition costs they pay to their Google Network members as part of AdSense (if you back that part of their business out, the cost of revenues drops to 14%). At the same time, Facebook spent 10% of its revenues on Marketing & Sales, as opposed to Google’s 7%. Lastly, Google outspent Facebook on R&D by more than 3.4x, accounting for 9% of their revenues as opposed to Facebook’s 7%. (+1: Google)

Operating cost structure: First of all, Google’s cost of revenues is significantly higher than that of Facebook, accounting for 40% of its revenues (as opposed to Facebook’s 23%). The primary difference is Google’s traffic acquisition costs they pay to their Google Network members as part of AdSense (if you back that part of their business out, the cost of revenues drops to 14%). At the same time, Facebook spent 10% of its revenues on Marketing & Sales, as opposed to Google’s 7%. Lastly, Google outspent Facebook on R&D by more than 3.4x, accounting for 9% of their revenues as opposed to Facebook’s 7%. (+1: Google)

- Network structure (i.e., walled garden vs. open): This has been an area of much-heated debate over the past few years, with many people comparing today’s Facebook to the 1990s AOL (and we all know where AOL is today). Sergey Brin gave this interview last month at the Guardian, and while it may appear self-serving, many of the points are valid, I believe. While Facebook now has over 900M users globally, their much-touted social graph is still a closed graph, and I believe this might be their Achilles’ heel. (+1: Google)

Google has continued to grow at a respectable 23% compound growth during the past 5 years to almost $38B in revenues last year and is still commanding a healthy 26% net margin. As of today, Google is worth $195B, with a P/E ratio of 18. At the same time, despite its attempts to diversify its revenue stream, Google still relies on advertising for 96% of its revenues.

In their amended S-1 filed last Monday, Facebook reported Q1 revenue of $1.058B, up 45% YoY, although their Average Revenue per User (ARPU), a closely-followed metric, only grew 6%. So, is Facebook still worth $104B after today’s IPO? Only time will tell, and although I do not believe so, I said the exact same thing during Google’s IPO in 2004, so please don’t take my word for it.

PS. I also ran these analyses accounting for inflation, but the results did not fundamentally change, and hence, I decided to stick to non-inflation-adjusted figures for simplicity.

Thank you for sharing this comprehensive analysis….brilliant! Agree with your conclusion….if yesterday’s performance in the market is an indicator I believe there are a quite a few more folks in our camp.

Great in-depth article, very insightful! What’s amazing is how the Net and Operating Margins converge. With a similar CAGR and lower growth rate at the beginning and everything , Facebook’s P/E ratio is not comprehensible. Also, I personally believe Google is more of a deep technology company than Facebook – which the higher R&D expenditures underline, meaning richer, future capabilities. The one point where I would differ is the fact of having a named user base of 900M that regularly log-in, having a high level of touch and familiarity and being able to capture the conversations between people, I would say, FB +1. But – is that worth double the P/E? I doubt it, unless FB has some magical plan up the sleeves what it will do with the cash it raised from the IPO and turbo-charge growth, lest the bubble will burst. Who knows…..

Seymour,

Thanks for your nice words. Indeed some of the results surprised me. Although I agree that Facebook’s 900M users are a huge asset indeed, I believe the closed nature of this social graph might be more of a disadvantage at the end.

See also this nice interactive chart from the NY Times on the IPO performance.

Hi Ted,

Thanks for the great analysis! It’s the best quantitative comparison I have seen between the two. Totally agree with the numbers reasoning, but qualitatively (also called ‘fluffy’ :-)) Facebook does have some very interesting strategic assets (e.g., no. of daily visitors and engagement, identity management etc), especially if you believe social commerce is the future, as search results increasingly become too crowded/ irrelevant rather than social filtering.

I think Google (also with Google+) will gravitate more towards a content delivery/ broadcast platform looking to expand the ads placement, while Facebook has to figure out the semantic relevance algorithms much better. Your ‘intent-based search’ advantage point is quite interesting though – really comes down to what you think is the future of commerce/ discovery.

Alex, thanks for the nice words. I agree that the qualitative unknowns will have to play themselves out over the next months and years, however (i) I am not a big believer in the nature of Facebook’s closed social graph, and (ii) in their 8+ years of existence, they have not really experimented much with alternative monetization models, except for payments…It will certainly be fun to watch how things develop….